Buyer's Course

Here's What You Need to Know About Buying a Home in Chandler, Arizona...

BUYER'S COURSE

Buyer's Blueprint Intro

Module 1: You Need An Expet

Module 2: Buyer's Compensation

Module 3: Choosing the Right Lender

Module 4: Making an Offer and Negotiations

Module 5: Your Offer Is Accepted

Module 6: Inspections Are Complete

Module 7: The Final Steps

Module 8: Erin Brockovich Buyer Compensation

Module 9: Should Sellers Offer Buyer Compensation

Module 10: The Buyer Representation Agreement

Module 11: The Listing Agreement

Module 12: The Purchase Agreement

Module 13: Which Offer Should You Choose

Whether you're a first-time buyer or looking to upgrade your living situation, our tailored market updates, captivating community videos, and comprehensive real estate insights make your home-buying journey seamless and enjoyable.

Exclusive Market Updates

Stay ahead of the curve with our up-to-minute market updates. From the latest listings to price trends, we ensure you have all the information you need to make informed decisions. East Bay's real estate landscape is dynamic, and with our expert analysis, you're always in the know.

Want to be sure you don't miss out on any local tips & local real estate market updates?

Have them delivered to your inbox.

Subscribe to the monthly digital newsletter below!

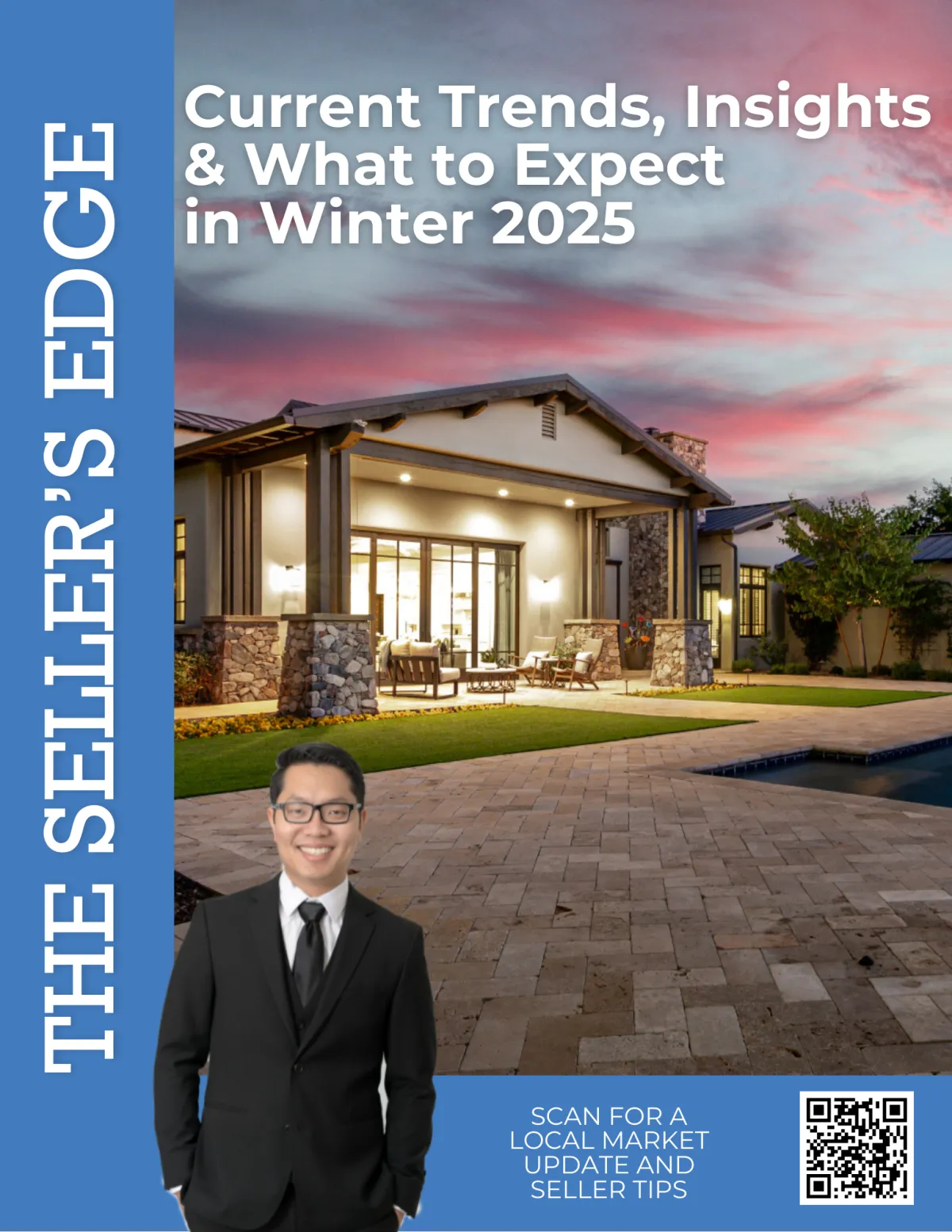

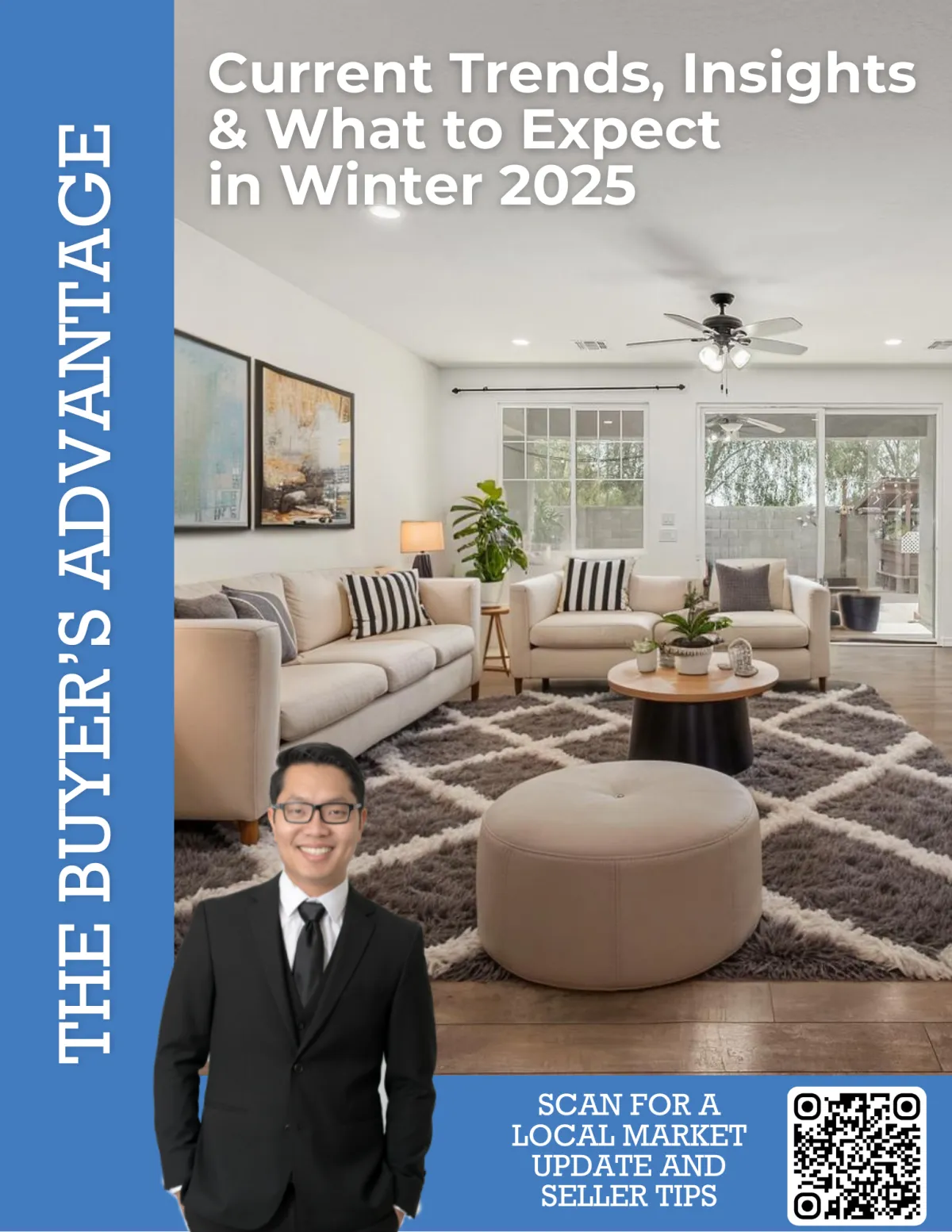

MARKET UPDATE

Considering Buying?

Buying a home can be an exciting but also challenging experience. If you're planning to buy an East Bay home, it's important to be prepared and aware of what to expect throughout the process. This short guide is designed to provide buyers like you with valuable insights and tips to navigate the purchase of your East Bay property successfully.

Preparing for a possible move this winter? Click below to check out our moving checklist to get your whole house ready for the next home!

Free Virtual Home Buyer Seminar

At the Magical Success Realty, we understand that buying a house can feel daunting and overwhelming.

That is why we have put together our Home Buyer Seminar with a step-by-step video series on everything you need to know before buying a property, getting your offer accepted and the transaction process. We’ve got you covered!

Join our Home Buyer Seminar and feel confident as you begin your journey to homeownership!

After Signing Up for the Workshop, You Will Get Instant Access to Long's Home-Buying Educational Videos

Take a sneak peek at what's inside the buyer seminar's videos!

Thinking About Buying?

"Are you thinking about buying a home but you don't know where to start?"

What to Expect When Buying a Home

"Purchasing a home is most likely going to be one of the largest investments you will make in your lifetime."

Home Buying Process- First Step

"The first step when looking to buy a home is getting qualified for a loan."

Pre-Approval vs

Pre-Qualification

"Why you need an approval rather than just a pre-qualification."

10 Must Not’s When Buying

a Home

"Once you find your dream home, we need to make sure you get to move into it."

What are the Pros and Cons of Purchasing a Home?

"Once you find your dream home, we need to make sure you get to move into it."

How Much Money Do I Need To Purchase a New Home?

"Are you thinking about buying a home but you don't know where to start?"

3 Tips To Get Your Offer Accepted

"Are you competing with other buyers on your dream home or do you want to make sure you’ve got the best chance of getting your offer accepted?"

Offer Has Been Accepted,

What’s Next?

"The first step when looking to buy a home is getting qualified for a loan."

Community Videos

Scottsdale Fashion Square Centre

1832 W Broadway Rd #100, Mesa

Biltmore Fashion Square

2502 E Camelback Rd, Phoenix, AZ 85016

Meet The Team

Here's our team that will help you throughout

the entire selling & buying process

Long Le

Team Leader

Tam Huynh

Operation Manager

Katrina Eserio

Content Manager

Louis Nguyen

Marketing Manager

Long Le | Team Leader REALTOR

The Magical Success Realty Team

Brokered by Your Home Sold Guaranteed

Meet Long Le

Long Le is a top-producing real estate agent serving Arizona’s West and East Valley. Known for exceptional service and sharp negotiation skills, Long makes every transaction smooth and stress-free.

Since 2019, he’s helped countless clients through Your Home Sold Guaranteed Realty with expert guidance in residential sales, first-time home buying, and investing.

With over 6 years of experience and a passion for real estate, Long is committed to exceeding expectations. Ready to buy or sell? Contact Long today!

Visit our blogs for more real estate tips, home tips, and local information!

Finding the right mortgage option for you

When it comes to choosing the best mortgage option, there's no one-size-fits-all answer. Every buyer’s financial situation is unique, and the key is to find a mortgage that fits comfortably into your monthly budget.

Understanding Your Options

There are plenty of mortgage options out there. FHA loans, conventional loans, and VA loans (for those who qualify) are all on the table. But which one is best? It really comes down to what you’re comfortable paying each month. The most important thing is to look at your monthly budget. If a certain loan option fits your monthly spending comfortably, that might be the right choice for you.

Negotiating in the Current Market

No matter which mortgage type you consider, this is actually a great time to negotiate some closing concessions. In many cases, you can negotiate about 2% to 3% in concessions from the seller. Since closing costs typically run around 1.5%, that extra concession can go toward buying down your interest rate.

Exploring Buy-Down Options

Interest rate buy-downs are a great tool right now. For example, you might consider a 2-1 buy-down, where your rate is lowered by 2% the first year and 1% the second year before returning to the normal rate. There are also longer-term options or fixed-rate buy-downs to consider. Just keep in mind that the more you buy down, the more it costs upfront. If you plan to refinance later, you’ll want to weigh whether those upfront costs are worth it.

Talk to the Experts

Ultimately, the best thing you can do is have a conversation with a knowledgeable real estate agent and a loan officer who understands your financial picture. They can help you figure out what monthly payment makes the most sense for you and guide you to the mortgage option that fits just right.

WHAT PEOPLE ARE SAYING ABOUT THE MAGICAL SUCCESS REALTY TEAM

Want to be sure you don't miss out on any local tips & local real estate market updates?

Have them delivered to your inbox.

Subscribe to the monthly digital newsletter below!